Navigating continuously evolving employment laws and wage regulations is a challenge for Australian businesses. Wage compliance is a legal requirement and a critical aspect of sustainable business practices. Failure to comply with new standards, such as the recent Fair Work Commission’s Annual Wage Review Decision 2023-24, could cost businesses penalties, leading to a loss of business reputation and operational disruptions.

Specifically, the implications of following the Fair Work Commission’s Annual Wage Review Decision 2023-24, issued on 3 June 2024, present a substantial change in regulatory conditions that employers cannot afford to ignore. With a 3.75% increase in the National Minimum Wage and all Modern Award minimum wages, coupled with upcoming legislation criminalising intentional underpayments, businesses that do not stay ahead of the new rules could face profound consequences.

Today, businesses require an innovative payroll solution that supports management, engages employees, and reassures clients of the company’s ability to deliver on promises. The solution must also ensure they are not singled out for underpayment due to incorrect annualised wage arrangement capturing and reporting.

Why is the Act Needed?

The changes to wage compliance and reporting come at a time when cost-of-living pressures have become a real concern for many Australians who are counting on every dollar from their employer. With an emphasis on support for workers, particularly those in low-income brackets, the rise in the minimum wage is just one way the government is helping individuals keep up with rising costs; ensuring every employee gets their fair pay is another.

Recently, a massive increase in payroll errors has underscored the need for the government to act. According to Forbes, a study found that Australian companies have made $1.35 billion in underpayments for the last 2 years. In a move to reduce wage miscalculations and underpayments, the government has actioned several items, including making intentional underpayments by employers a criminal offense by incorporating this into the Fair Work Act as part of the new ‘Closing Loopholes’ laws. This new standard is set to come into effect this year, underscoring the urgent need for employers to update their payroll practices.

What Does This Mean for HR Managers?

HR Managers must face the complex task of understanding and implementing the annual review process for annualised salaries, ensuring that all employees are compensated at or above the new minimum rates, and adapting to the relevant industry sector-specific pay bracket. The burden of implementation and tracking wages can be significant, especially for businesses without dedicated HR or legal departments to interpret and apply these changes.

The stakes for non-compliance have also increased, with considerable penalties for businesses that fail to meet their obligations. Recent high-profile cases like a leading Australian bank fined a record-high $10.3 million for underpaying employees underscore the costs of breaking the rules. This case and others like it demonstrate that even large, well-resourced organisations are at risk and violate wage compliance laws.

Solutions for HR Managers

In the face of these complicated annualised wage requirements, technology and automated platforms offer managers a robust solution, and according to new research, streamlining challenging employment compliance requirements with modern solutions can also boost productivity.

WorkForce Software’s industry-leading software and compliance platform is a market-leading solution designed to simplify compliance and streamline wage management by providing real-time calculations and visibility—both aspects of reporting that have been elusive until now.

Here’s How Workforce Software’s AWA Platform Can Help:

WorkForce Software’s platform is a cloud-based people management software that can help maintain compliance of annualised award wages by offering real-time alerts and calculations, instantly identifying under and over-payments of award variances. With this modern workplace solution, managers can prevent underpayment, enhance transparency, and ensure fair payment practices, which are mandatory in today’s competitive and complex landscape.

A gold standard in compliance, WorkForce Software’s intuitive platform is a customisable solution that eliminates the need for manual calculations and can be deployed in a variety of sectors, including retail, hospitality, healthcare and more.

Below, we explore the key aspects of this dynamic solution:

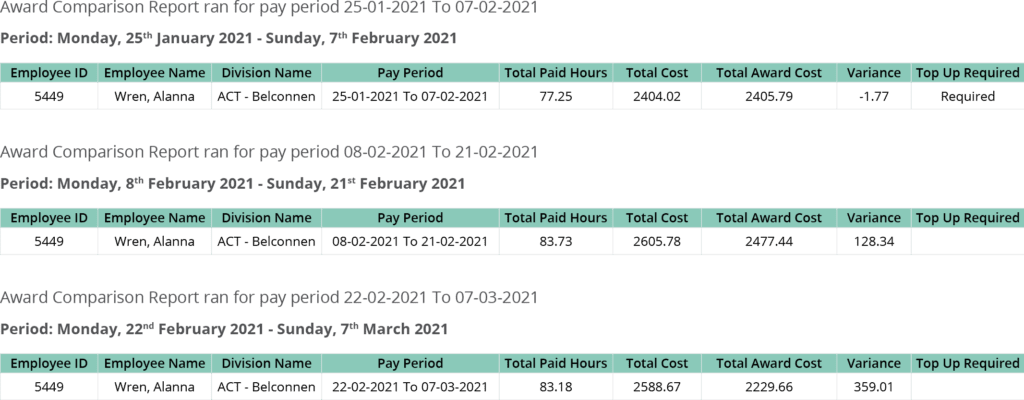

- Realtime calculations—Automatically identify under and overpayments for specified periods, empowering managers to proactively adjust rosters, which can uncover significant cost savings and boost employee engagement. (Figure 1)

- Automation of awards—This platform, which can be tailored to be industry-specific, features award calculations that are automated daily, providing useful insights in real-time as shifts are captured.

- Quick comparisons—Employers have a comprehensive view, allowing them to instantly review and adjust employee’s annualised salary against calculated award wages.

- Proactive alerts and notifications—Send and receive automated push notifications when an employee requires an award based on their roster, allowing for proactive adjustments and improved compliance.

- Time saving—Manual calculations are now automated, eliminating the risk of human error and allowing staff to focus on other high-value activities.

The Future of Wage Award Management

By leveraging WorkForce Software’s innovative solution, businesses can confidently navigate the multifaceted requirements of annualised wage arrangements. They can also effectively manage budget costs confidently with accurate time capture, empowering managers with peace of mind in terms of resource allocation. This robust compliance platform’s features with real-time capabilities and proactive alerts help minimise risks and severe annualised award wage fines, save time, and ensure your business meets the Fair Work Commission Annualised Salary arrangements.

With this powerful solution, organisations can streamline and automate their back-office reporting and scheduling and eliminate costly wage errors by aligning with Fair Work Commission Annualised Salary standards.

To learn more about this cutting-edge, cloud-based solution, please visit WorkForce Software for more information.